Tenants, curious how rent to own works? Below are two examples of a purchase.

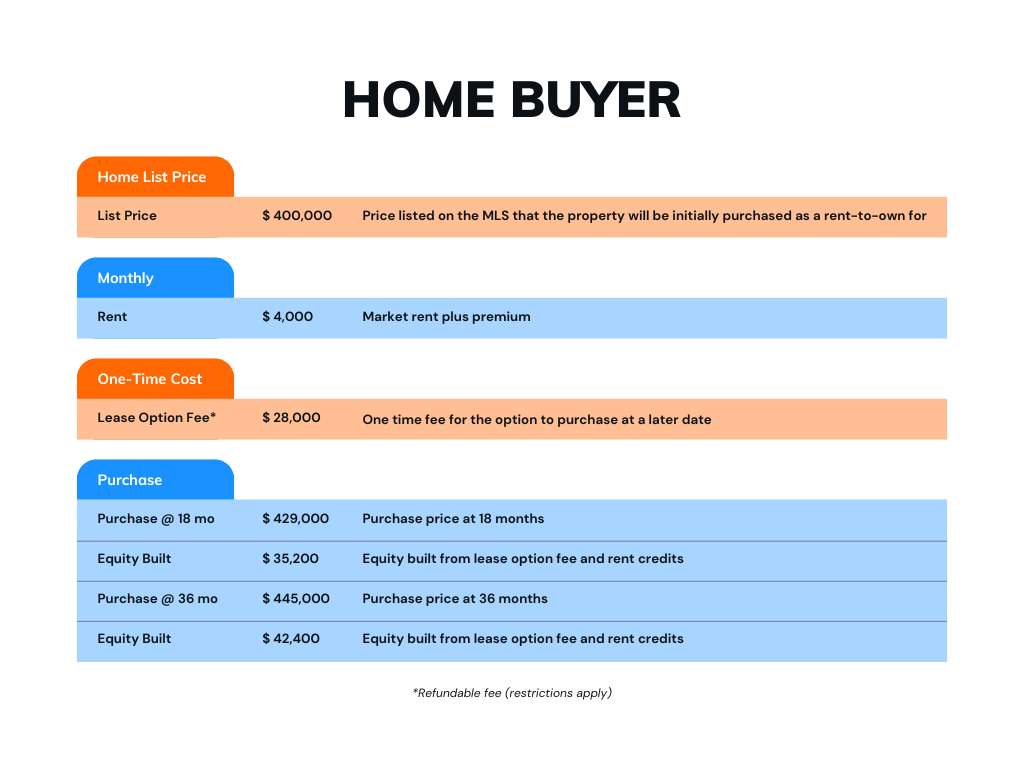

Example #1 of rent-to-own home purchase

In this example, a home owner wants to purchase a home for $400,000. They can afford a monthly rent of $4000. The home owner can get connected with an investor who can purchase the home on their behalf with the agreement of a one-time lease option fee of $28,000.

Once the home owner has rented the home for 18 months, they can choose to purchase the home from the investor for the previously agreed upon price of $429,000. At this time, the home owner will be able to take ownership and gain $35,000 of equity in the home.

If the home owner chooses to wait until 36 months before purchasing, the price, previously agreed upon, will be $445,000. Purchasing at 36 months, the home owner be able to take ownership and gain $42,000 of equity in the home.

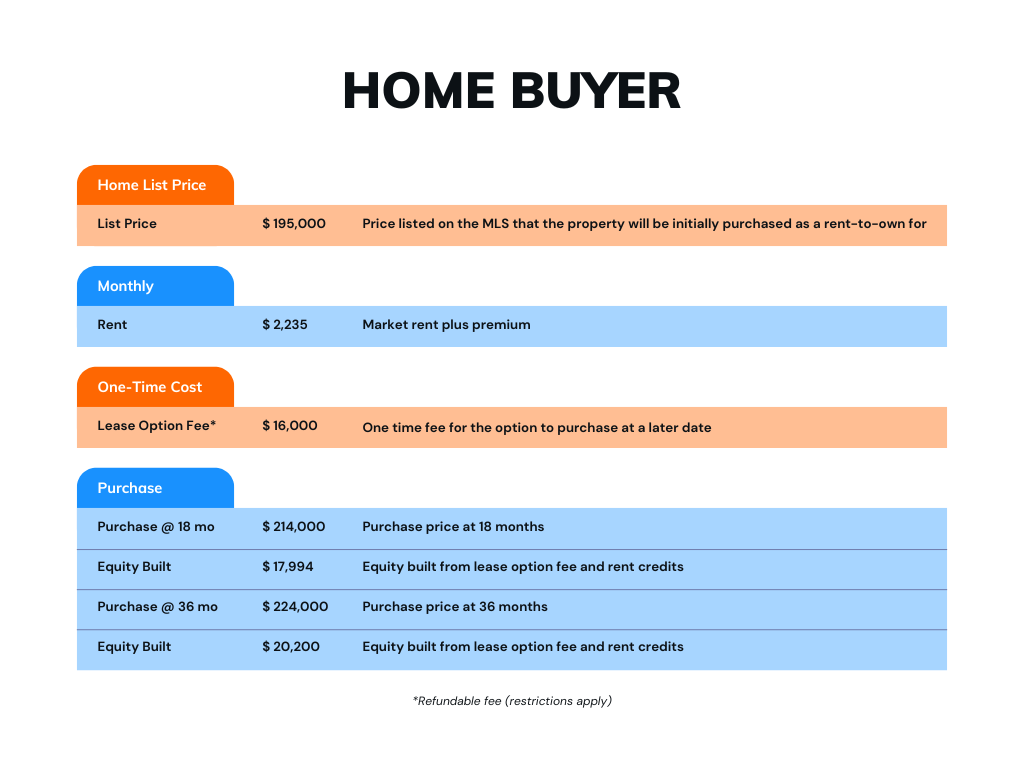

Example #2 of rent-to-own home purchase

In this example, a home owner wants to purchase a home for $195,000. They can afford a monthly rent of $2235. The home owner can connect with an investor who can purchase the home on their behalf with the agreement of a one-time lease option fee of $16,000.

Once the home owner has rented the home for 18 months, they can choose to purchase the home from the investor for the previously agreed upon price of $214,000. At this time the home owner will be able to take ownership and gain $17,994 of equity in the home.

If the home owner chooses to wait until 36 months before purchasing, the price, previously agreed upon, will be $224,000. Purchasing at 36 months, the home owner be able to take ownership and gain $20,200 of equity in the home.

Zegacy can help you find your dream home

Getting started is easy

01

Sign up for Zegacy.com and submit the home you want

02

Get matched with an investor and agree on monthly rent

03

Sign lease agreement and move in!