frequently asked questions

Zegacy is a virtual matchmaking platform that connects potential homeowners with real estate investors, offering an alternative to traditional bank loans through lease-purchase options (i.e.rent-to-own)

Zegacy facilitates rent-to-own agreements by acting as a matchmaker, connecting tenant buyers with private real estate investors to arrange structured rent-to-own agreements.

A tenant is a rent-to-own home buyer who can be matched with an investor to finance the purchase of the home.

An investor is a private individual or private entity providing financing/funds to purchase a property on behalf of the tenant.

Individuals interested in rent-to-own home buying and investors looking to engage in lease-to-own real estate investments can benefit from using Zegacy.

Zegacy prioritizes security by only sharing personal information with consent to ensure a successful match, storing all sensitive data securely on internal servers.

The duration varies by negotiation, ranging from 1 to 5 years, with 3 years being the average.

Zegacy does not list properties directly but matches tenant buyers with private investors who purchase homes on their behalf, suitable for a lease with an option to buy.

Penalties are similar to those of a traditional rental: risk of eviction and loss of any equity. If an investor fails in their obligations (e.g., taxes, insurance), tenants may cover these costs and deduct them from the purchase price, varying by state.

Zegacy does not intervene in disputes. Users are advised to seek legal representation or consult with an attorney as their first line of defense.

Zegacy provides a library of resources to help tenants and investors navigate through the rent-to-own journey.

Costs vary based on negotiation between the tenant and the investor. Terms generally improve with lower risk perceived by the investor and more attractive tenant profiles.

The tenant needs funds at the time of executing a purchase agreement, similar to a security deposit. The investor pays earnest money initially, with the majority of funds due at closing.

A lease option gives the tenant the right, but not the obligation, to purchase the property at the end of the lease. A contract for deed involves payments to the seller until the price is fully paid, then the title transfers.

Get into rent-to-own investing with confidence

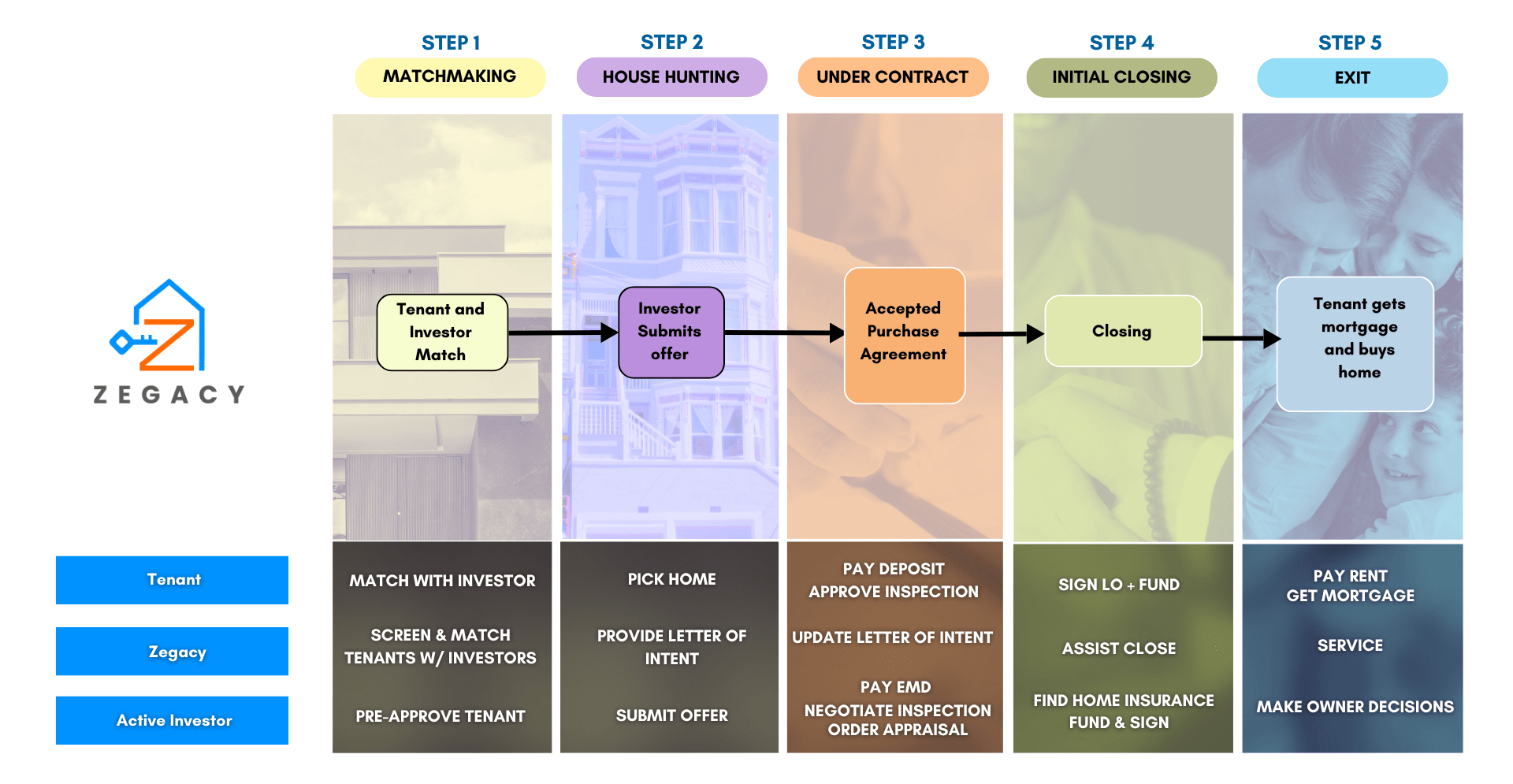

Our proven process helps you navigate rent-to-own to accelerate your investing

Zegacy versus Traditional Mortgage Process

Pre Approval Process

Zegacy - Tenants get pre-approved by private investors, similar to bank pre-approvals.

Traditional - Home shoppers obtain pre-approval from banks based on creditworthiness.

Home Selection

Zegacy - Tenants can choose from any home on the open market that meets the investor's criteria.

Traditional - Home buyers can choose any home that meets their budget and bank’s lending criteria.

Financing

Zegacy - Investors buy the home, tenant pays rent with an option to buy.

Traditional - Bank lends money directly to buyer to purchase the home.

Financing Role

Zegacy - Investors act as both financiers and temporary property owners.

Traditional - Banks act solely as lenders, not property owners.

Commitment

Zegacy - Tenants commit to potentially buying the home, gaining equity over time.

Traditional - Home buyers commit to mortgage repayments to retain ownership from the start.

Flexibility

Zegacy - Rent-to-own offers a trial residential period before final purchase, flexible under terms negotiated with the investor.

Traditional - Mortgages are less flexible, with fixed terms based on loan agreement.